I would like to introduce you to the world of private banking and more particularly to a risk-management analyst, we will name her Mandy, who is working for an international private bank in Geneva. The person and the bank’s names will remain undisclosed for privacy reasons.

I would like to introduce you to the world of private banking and more particularly to a risk-management analyst, we will name her Mandy, who is working for an international private bank in Geneva. The person and the bank’s names will remain undisclosed for privacy reasons.

Through this article and the interview that was undertook, we will understand more about the duties of a risk-management analyst as well as how she managed her recent career move from the marketing world to working in the financial field. In addition, we will see what it takes to become a successful risk-management analyst and what she likes and dislikes about this new role.

As a risk-management analyst, Mandy is responsible for:

She has to verify that investors send the right documentation before placing the trades so clients are fully aware of the products they are investing in.

When the investors/advisors travel overseas for business purposes, they have to follow internal procedures aligned with the “Cross Border” policies. This has been implemented to follow and respect local rules. Therefore, she has to check that they upload all relevant information of the trip in the system and that they respect these rules.

Furthermore, Mandy explains that there are regional differences in regulatory requirements. She mentions that each country has different restrictions on how to do business, therefore it is very important to be aware of each region’s rules and to strictly follow them.

Mandy is new to the financial world. She used to work in marketing until she had the opportunity to change her careers to a position in a private bank a few months ago. Therefore, in the beginning, it was a bit overwhelming for her because everything was new: the banking slang, the strict procedures, the programs etc… Firstly it took her some time, patience and a lot of training to get used to all the banking systems and the procedures. She had to learn really fast because it is a very competitive environment. After a few months, she finally started to feel more confident and was getting more and more responsibilities which showed her that her boss was trusting her ability to perform well. She believes that what helped her to quickly adapt was the fact that the team was always open to help her if she had any questions or any doubts. In addition, they let her learn each new task step by step and gave her the time to feel confident before teaching her something new.

Mandy explains that the most challenging part of her job is to tell the investors, who have many years of experience, what they need to arrange/update. In addition, it is very challenging to make them listen to you because, at times, they may not like to hear that they did something incorrectly.

In the morning, she always has a cup of coffee to wake-up and be ready for the day ahead. Then, she has to check the “tracker” which is a spreadsheet that include the tasks of the day that she is responsible for. She particularly appreciates that they use the “tracker” system because she always knows what she has to work on during the day and can organize her time as she wishes.

Then, during her whole day, she has to arrange different types of task/reviews. The bank uses a “4-eyes checks”: which means that there are four people in total doing post-trades reviews.

The qualities and competence to work for the risk-management department of an international private bank are:

What Mandy prefers in her job is the contact she has with different departments, performing the reviews, organizing her time accordingly and speaking in Spanish with the LATAM team members.

What Mandy dislikes in her job is the sort of rigid banking environment which highly differs from the fun and open-minded marketing field. There are very strict procedures to follow and there is not much room for outside-the-box thinking. She believes that the internal and external audit controls that the bank has every year put a lot of pressure on employees to strictly follow these procedures.

The atmosphere at Mandy’s job is particular, everyone works for long hours but still takes time to talk to each other and make some jokes which is nice to experience, especially in this strict banking environment.

With regards to working-schedules in most international private banks, it is really difficult to get a part-time position. Most employees work full-time, however, Mandy was able to discuss with her boss to work 90% because she has a young child at home.

Mandy also explains that they are currently many job opportunities at her bank, mostly for experienced individuals and fluent English speakers. The banking industry is always growing and is an influent recruiter here in Geneva.

With regards to the “Swiss Secrecy”, Mandy explains that Swiss banks are now aligned with the FACTA rules** (Foreign Account Tax Compliance Act), and they also signed a similar agreement with the European Union. The Swiss institutions are now obligated to reveal account information if necessary. However, clients still have their privacy and Swiss banks maintain a solid reputation in relation to Financial Secrecy.

In addition, Mandy thinks that the Swiss financial industry will keep growing and getting stronger in the years to come because Swiss banks are allies of foreign corporations and individuals for their low taxation. Furthermore, they are adapting their “Swiss Secrecy” to the new rules and are still going strong.

To conclude, working in a private bank as a risk-management analyst is challenging with the several strict banking procedures to follow but it can also be very rewarding. Mandy’s story also shows that anyone can make a successful career change. It may be difficult in the beginning as you are new to everything and you will have to remain patient and work hard to learn your new tasks but it will pay off at the end.

*Post-trade: processing, after a trade is complete, goes through post-trade processing, where the buyer and the seller compare trade details, approve the transaction, change records of ownership and arrange for the transfer of securities and cash. http://www.investopedia.com/terms/p/post-trade-processing.asp

** The Foreign Account Tax Compliance Act (FATCA) is a piece of US legislation designed to prevent tax evasion by US citizens using offshore banking facilities (source: http://www.out-law.com/en/sectors/financial-services1/banks/foreign-account-tax-compliance-act-fatca/)

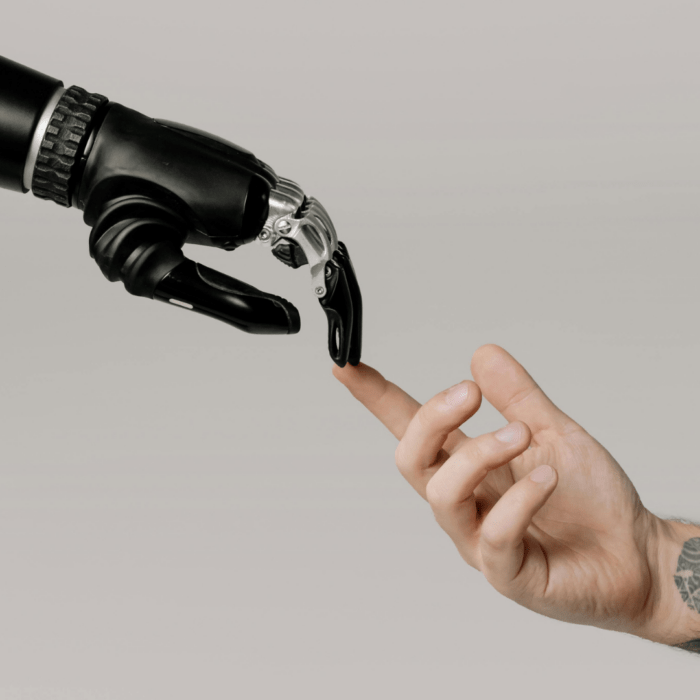

Photo credit: Robert Kneschke via fotolia.com