Wall Street, New York

In the fast-paced world of finance, the US banking industry is on the brink of a game-changing shift: T + 1 settlement for equities and corporate bonds.

This innovation promises to revolutionize how financial transactions are settled, and its ripple effects will touch everyone from investors to financial institutions.

In this article, we'll dive into what T + 1 settlement means, why it's happening, and what it means for you.

T + 1 settlement, simply put, means settling financial transactions just one business day after the trade takes place. Currently, most transactions in the US follow a T + 2 settlement cycle, which means it takes two days for assets and funds to change hands. T + 1 slashes that time-frame by a day, bringing us closer to real-time settlement.

So, why is this happening? Several factors are driving the shift:

Efficiency: T + 1 settlement is all about making financial markets faster and more efficient. It streamlines the process, reduces operational costs, and makes trading easier.

Risk Reduction: With T + 1, there's less time for things to go wrong. This reduces the risk of trades not settling, which can be a headache for everyone involved.

Tech Advances: Thanks to technological advances, T + 1 settlement is not only feasible but secure. Automation and digitalization play pivotal roles in making it work.

The move to T + 1 settlement comes with some exciting potential benefits:

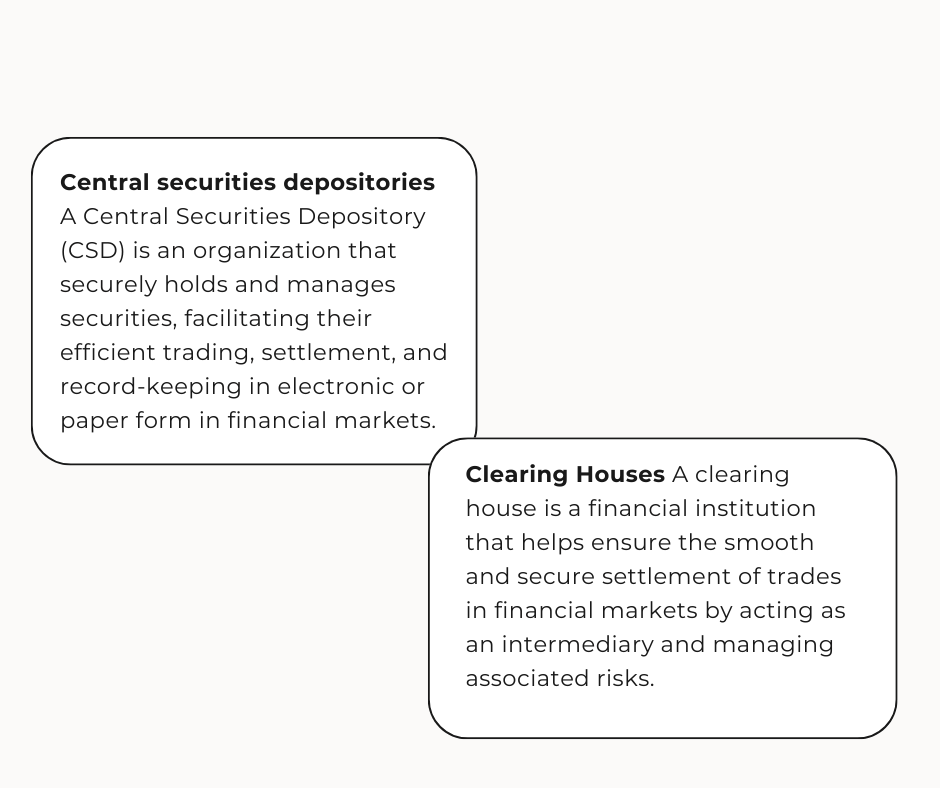

The change will take place for the US market on 28 May 2024. India already moved to T + 1 at the beginning of 2023, and Canada will precede the US by one day. Within Europe, no decisions have been made so far, as each country has their own diverse settlement system. Streamlining between the various central securities depositories and clearing houses will need to be achieved before this can even be considered.

Anyone who trades equities or bonds on the US or Canadian market. The banks in Europe will still be affected by these changes as almost all will have some exposure to these markets.

A faster settlement cycle means less time to iron out problems. Trades will need to be affirmed on the trade date, and the window for resolving any potential issues will decrease. It will be interesting to see what happens in the US, particularly concerning the number of trades failing to settle. Europe can then learn from this and apply it to its much more diverse and complex ecosystem.

T + 1 settlement is a bold step towards a more efficient and secure financial future. It may pose challenges, but the rewards of reduced risk, increased liquidity, and potential cost savings are worth it. As the banking industry gears up for this transformation, the question is how long will it take for Europe and the rest of the world to follow? It is a big leap worth keeping an eye on!

Photo Credit: ID12930906© Songquan Deng|Dreamstime.com