The end of the accounting year in Switzerland is a time to ensure accurate and reliable financial reporting.

This process involves a number of steps that guarantee all accounting documents are recorded within the relevant period, providing unit and fund managers with up-to-date information.

Adhering to accounting standards such as Swiss GAAP FER and IFRS, and understanding the importance of assets and liabilities on the balance sheet, are essential for maintaining financial stability and transparency.

This article explores the key aspects of closing an accounting year, the significance of accounting standards, and the critical role of the balance sheet in reflecting a company’s financial health.

Accounting Standards in Switzerland

Switzerland follows two main accounting standards: Swiss GAAP FER and IFRS. Additionally, commercial bookkeeping and accounting are regulated by the Swiss Code of Obligations.

- Swiss GAAP FER (Generally Accepted Accounting Principles):

- Swiss GAAP FER provides a robust framework for financial reporting.

- It is suitable for various companies, including listed firms, national groups, and small to medium-sized enterprises.

- Structured in modules (core FER, full Swiss GAAP FER, and listed companies), it accommodates different company sizes.

- Industry-specific standards cover areas like pension funds, insurance companies, and not-for-profit organizations.

- Small organizations can apply the framework concept and six core standards (core FER) if they meet specific criteria.

- International Financial Reporting Standards (IFRS):

- IFRS is globally recognized and widely used by multinational companies.

- While not specific to Switzerland, some Swiss companies adopt IFRS for consistency and comparability.

- IFRS emphasizes transparency, comparability, and high-quality financial reporting.

- Commercial Bookkeeping and Accounting :

-

- Swiss Code of Obligations (Articles 957 ff.) governs commercial bookkeeping and accounting.

- These regulations apply to all Swiss companies, including sole proprietorships, partnerships, and legal entities.

- Minimum requirements include balance sheet structure, income statement format, and notes to financial statements.

- Valuation and Hidden Reserves :

-

- Valuation should be cautious, ensuring an accurate assessment of the company’s economic situation.

- Hidden reserves (undisclosed profits) are permissible but should not distort financial reporting.

Importance of Assets and Liabilities in the Balance Sheet

Financial Stability and Liquidity: The balance sheet reveals a company’s financial stability and liquidity. A balance of current assets and liabilities is crucial for liquidity, indicating the company’s ability to meet short-term obligations.

Asset and Capital Structure: The balance sheet shows how a company finances its assets. A high equity ratio suggests financial soundness, while a high debt ratio may indicate higher risk.

Leverage Effect: This describes the ratio of debt to equity. High debt levels can increase company risk due to interest and repayment obligations and also lead to higher returns for equity investors if investments are successful.

Overall Importance of Assets and Liabilities on the Balance Sheet

Assets and liabilities on the balance sheet provide crucial insights into a company’s financial health and stability in Switzerland. Understanding the various types of assets and liabilities, and their valuation principles, enables companies, investors, and other stakeholders to make well-informed decisions.

Compliance with legal regulations and accounting standards is essential for ensuring the transparency and comparability of balance sheets. Business owners must manage their accounting diligently and accurately value their assets and liabilities to present a true picture of their financial performance and stability.

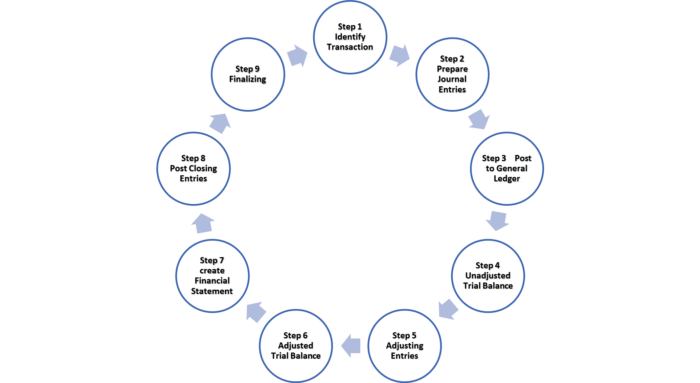

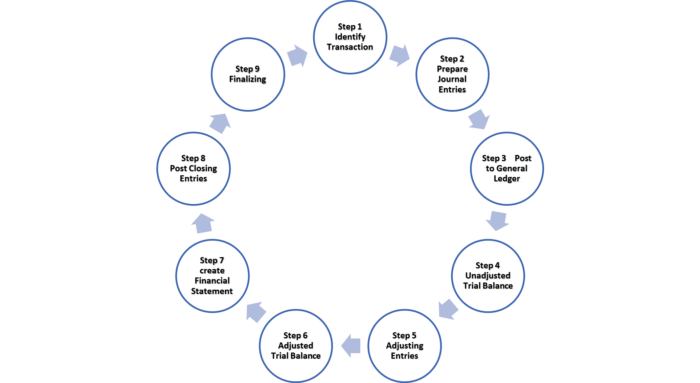

The Accounting Cycle

Accounting closure ensures the accurate recording of all financial documents within a specified period, providing reliable and up-to-date information for unit and fund managers. Let’s delve into the key aspects of closing accounts in Switzerland:

- Closing Date:

- Typically, companies close their accounts at the end of the calendar year (December 31). However, flexibility allows companies to choose another date that aligns with their explicit needs.

- In the year a company is established, entrepreneurs can opt for either a short financial year (ending at the first year’s close) or a long financial year (ending at the subsequent year’s close).

- For instance, if a company is founded on July 1 and decides to close its accounts on December 31, it can select a financial year lasting either six or 18 months.

- Note that the maximum duration of the first financial year varies across Swiss cantons (up to 23 months in some and limited to 15 months in others).

- Long Financial Year Benefits :

- In cantons without standard corporation tax, choosing a longer financial year can be advantageous. Start-up costs incurred during the initial year can be offset by subsequent revenue.

- This strategic approach helps manage financial obligations effectively.

- Seasonal Businesses:

- Seasonal businesses (such as tourism or construction) should carefully consider their closing date.

- To optimize tax benefits, the closing date should precede the seasonal peak. A fully stocked pre-season warehouse can contribute to building reserves.

Fiscal Aspects of Closing Accounting

Before finalizing the accounting process, several critical operations with fiscal implications must be carried out. Let’s explore these key steps:

Inventory Adjustment:

The inventory account needs to be adapted. This involves reconciling physical stock with recorded values to ensure accuracy.

Depreciation Transactions:

Transactions related to asset depreciation (such as machinery, equipment, or vehicles) must be entered. Depreciation affects the company’s financial statements and tax liability.

Transitional Income and Liabilities:

Assess any transitional income or liabilities that impact the financial position during the transition from one accounting period to another.

VAT Declaration:

Complete the Value Added Tax (VAT) declaration. Accurate VAT reporting is crucial for compliance and managing tax obligations.

Profit or Loss Attribution:

Determine how to allocate the profit or loss. This decision affects tax liability and financial reporting.

Consult with your tax advisor or accountant to make informed choices based on your circumstances.

Verification and Checking:

Conduct thorough verification and checking of all financial data. Accuracy is essential for compliance and reliable reporting.

Keep in mind that while the program may not distinguish between high and low profits, fiscal implications can greatly affect your financial standing. Seeking advice from a specialist, particularly if you’re new to managing accounting, can offer valuable insights. Accountants tend to be very busy during tax declaration periods, so it is wise to meet with them or share your accounting files well before closing the books. The eventual distribution of profits to shareholders will depend on the company’s structure (e.g., SA, SARL, etc.).

Importance of the Closing Process in Accounting

The closing process is vital in accounting as it prepares a company for the next accounting period by clearing any outstanding balances in specific accounts that should not carry over. This process involves returning these accounts to a zero balance.

The primary goals of the closing process are to:

- Summarize financial activities

- Ensure accuracy in reporting

- Facilitate informed decision-making by stakeholders

Monitoring the closing balance at the end of each accounting period is crucial. It indicates whether a business is overspending or not generating enough revenue. A negative closing balance signals the need for changes.

Closing entries affect the profit and loss of a business only within a specified reporting period, typically a month, quarter, or year. These entries are reported on the income statement for that period. Other transactions may have more long-term effects on the business.

Four Types of Closing Entries

- Close Revenue Accounts: Transfer all revenue account balances to the Income Summary account.

- Close Expense Accounts: Transfer all expense account balances to the Income Summary account.

- Closing Income Summary Account: For shareholders’ companies (SA), the balance of the Income Summary account is transferred to the Retained Earnings account. For limited liability companies (Sarl), each partners' capital account will be credited based on the agreement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C). In the case of sole proprietorship, it’s also transferred to the owner’s capital account.

- Closing Dividends (or Withdrawals) Account: This step applies only to shareholders’ companies (SA). Any balance in the Dividends or Withdrawals account is transferred to the Retained Earnings account. This is closely aligned with Close withdrawals to the capital account: For sole proprietorships and partnerships: In a sole proprietorship, a drawing account is maintained to record all withdrawals made by the owner. In a partnership, a drawing account is maintained for each partner.

In conclusion, closing an accounting year in Switzerland is a meticulous process that ensures the accuracy and reliability of financial reports. By adhering to established accounting standards and carefully managing assets and liabilities, companies can provide a transparent and accurate picture of their financial performance.

This not only aids in compliance with legal regulations but also supports informed decision-making by stakeholders.

Understanding the accounting cycle, particularly the closing process, is vital for maintaining financial stability and preparing for future financial periods. Business owners and accountants must work diligently to ensure that all financial activities are accurately summarized and reported, fostering trust and confidence among investors and other stakeholders.

By the same author:

VAT in Switzerland: Implications and Insights

The best accounting software in Switzerland

Sources: SECO, Dates for closing accounts

Images: depositphotos