A financial model helps businesses to make better choices quickly, confidently and accurately.

A financial model helps businesses to make better choices quickly, confidently and accurately.

Financial models are predictions based on informed assumptions on the behavior of key internal variables. These include expenses, revenue and working capital. These all impact on the overall business fundamentals.

Usually financial models are spreadsheet-based tools that helps translate abstract representations of real world financial situations, such as asset prices.

They also provide insights into market directions from processed data, which are important for scenario analysis and, as part of a management tool to track KPIs, metrics, and other key data points relevant to a business.

Uses of financial models are wide and varied, and include:

- Business valuation (for example, to estimate the economic value of an owner's interest in a business)

- Optimization, managing and controlling risk (particularly when forecasting factors that could affect profits)

- Managing assets and liabilities

- Budgeting of capital needs

- Forecasting business cash flow

- Asset pricing and calculating the cost of capital

- Investment decision making, such as in M&As (mergers and acquisitions)

- Raising capital

It is important to state that the quality of a model depends largely on the quality of the assumptions made about the economic drivers of a business. Therefore, the judgement of the financial modeler is important when determining and weighting variables that will most accurately reflect these assumptions.

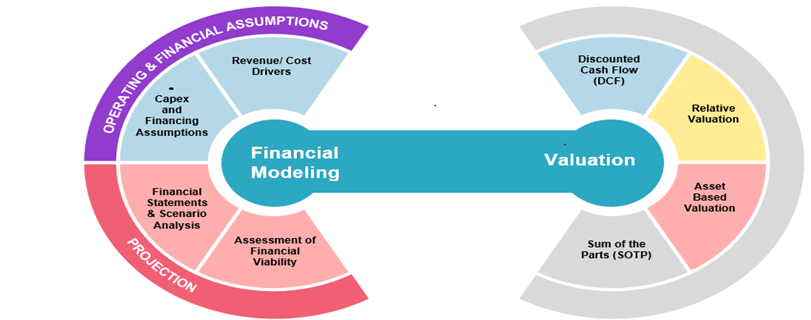

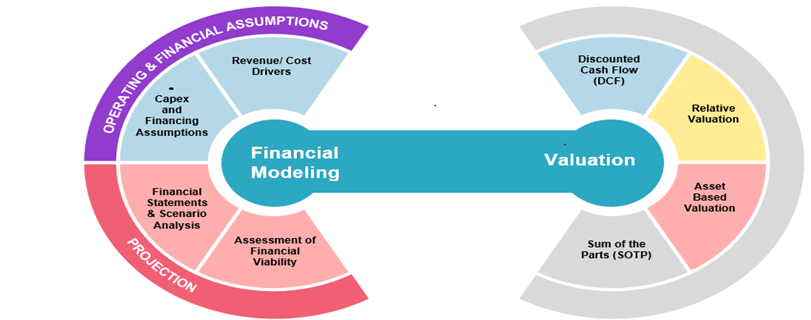

Schema showing how financial modelling is applied in business valuation

But what makes a good financial modeler?

There are a number of skills that should stand out, such as having:

- a strong sense of detail

- superb business sense and a deep understanding of the core business of the company

- good judgement and an intuition about business risk

- knowledge of the market, current, historical, and where trends are taking it

- “inside-out” knowledge of spreadsheet programs (such as Excel or Python)

- presentation skills including excellent knowledge of PowerPoint

- knowledge of industry best practice when presenting information (i.e blue represents stable numbers, black is for cells with formulae…etc).

Financial modelling is, however, an art and science. Numbers and trends can be predictable. At the same time, informed judgement and a bit of intuition gained from experience is required for an effective insight into the financial future and value of an organization.

Sources:

https://www.bloomberg.com/opinion/articles/2019-04-08/financial-models-are-not-a-substitute-for-good-judgment

http://ncsp.org/exactly-financial-modeling/

https://fitceo.com/business-and-financial-models/

https://www.cleverism.com/financial-statement-analysis-introduction/

https://www.edupristine.com/blog/benefits-financial-modeling-course

A financial model helps businesses to make better choices quickly, confidently and accurately.

A financial model helps businesses to make better choices quickly, confidently and accurately.

first of all, I would like to thanks a lot for writing such an informational blog about FINANCIAL MODELS.I got here, what I wanted about digital marketing

Interesting Things.