Stephen Anthony

We are always on the lookout to interview interesting people in Geneva; the people who enrich and diversify this town. This time, we did not have to look far. We decided to speak to our very own Stephen Anthony, Senior Financial Correspondent for GBN.

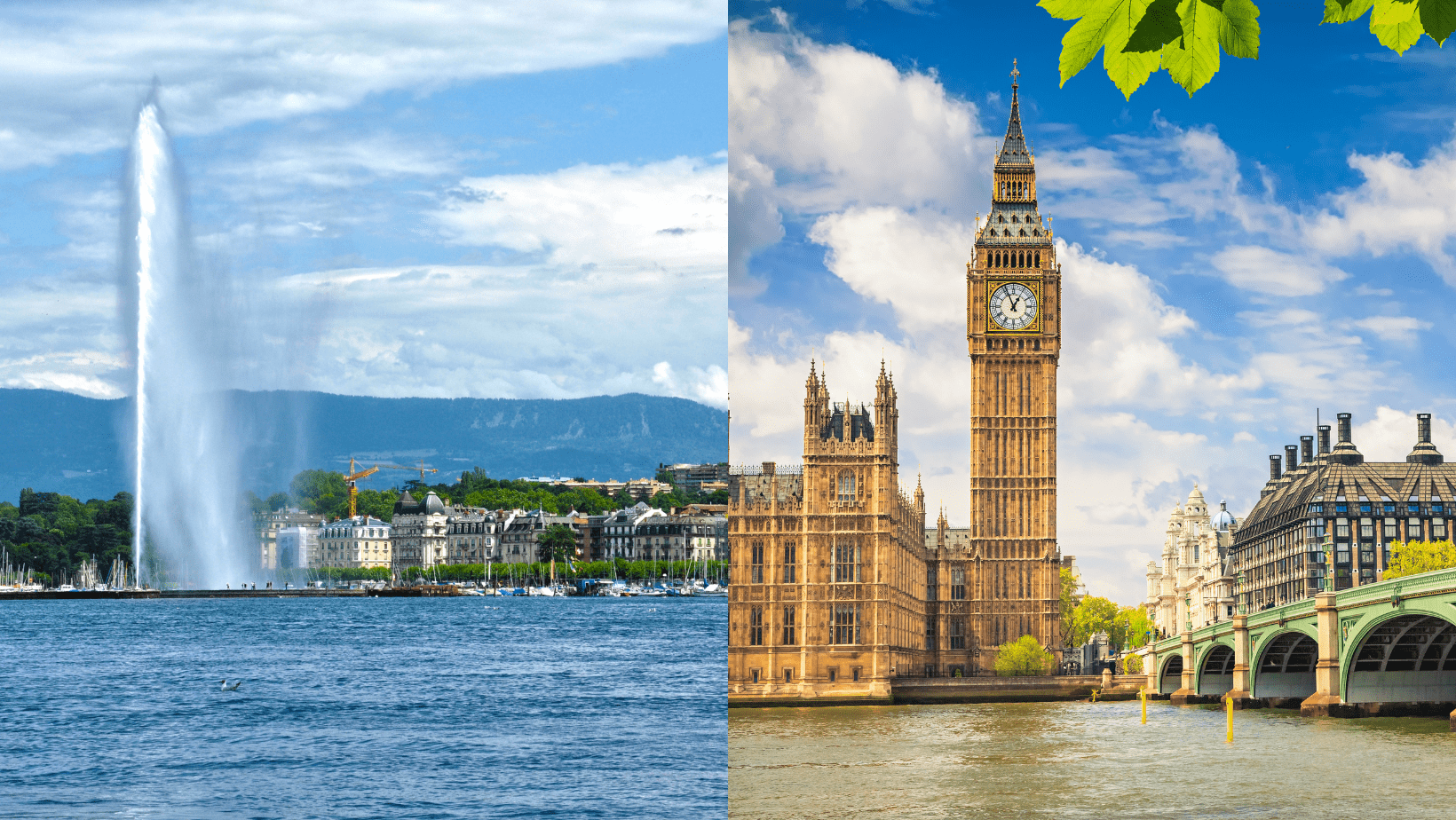

Stephen Anthony's journey in private banking began at Barclays Bank in Geneva in 1998. Initially a summer job handling printed confirmations, but he quickly expanded his role by organizing accounts and assisting colleagues. Moving to Lloyds Private Banking, he took on more responsibilities, such as resolving issues with other banks and addressing cash differences with traders. After a year of banking experience in Geneva, he returned to London, where he had previously studied music technology.

Moving from Switzerland to the UK, Stephen observed the vast difference in market size, with London having the largest marketplace. He experienced a significant shift, transitioning from working in a team of 10-20 people to collaborating with thousands. While both Geneva and London have unique markets, a significant portion of the trade from Switzerland ends up in the UK. London's trading is more reactionary and complex, dealing with transactions between institutions rather than end clients. Stephen highlights the theoretical ease of relocating from the UK to Switzerland but emphasizes the challenge of new environments and evolving laws. Additionally, Stephen notes the commonalities and differences between Swiss and EU banking regulations. While they share features in international banking standards and anti-money laundering/know your customer (AML/KYC) requirements, disparities exist in market access, regulatory authorities, and deposit insurance schemes due to Switzerland's non-membership in the EU.

Although it later underwent substantial automation, reducing workforce needs, the banking industry was blooming in the nineties. Stephen thrived in London’s fast-paced environment, recalling the adrenaline rush of making quick decisions during the industry's golden era. He vividly describes the manual process of picking up trade tickets from traders, deciphering their often hurried and illegible notes, and entering the data into the system—an antiquated process compared to today's electronic efficiency.

The financial industry has undergone significant changes in recent years, particularly in the realm of regulation and automation. Initially, traders had the freedom to charge any price, as long as both parties agreed. However, the introduction in the European Union of regulations like EMIR (European Market Infrastructure Regulation), MiFID (Markets in Financial Instruments Directive) and MiFID II mandated "best execution," requiring traders to prove they sought the best price for clients, a shift from the previous laissez-faire approach. These regulations emerged as a response to the EU's desire for a more controlled and client-focused trading environment, akin to consumer protection regulations.

EMIR was introduced to enhance transparency and reduce risks in the derivatives market. It focuses on mandatory clearing of standardized over-the-counter (OTC) derivatives, reporting of derivative transactions, risk mitigation for non-cleared OTC derivatives, and the regulation of central counterparties.

MiFID, implemented in 2007, aimed to harmonize and regulate financial markets and services within the EU. It introduced rules for investment firms, trading venues, investor protection, and transparency. MiFID II, implemented in January 2018, is a comprehensive revision with detailed rules enhancing transparency, investor protection, and market integrity. It includes mechanisms like the double volume cap, rules on trading in financial instruments, and increased reporting requirements.

During his tenure in London in 2007, Stephen experienced a unique challenge when a terrorist attack struck the London tube while he was in Paris for a work assignment. Amid the chaos, he found himself running his entire department from Paris, receiving instructions from bosses via Blackberries, coordinating with various departments, and handling his regular duties. The stress of the situation was mitigated by the intense busyness of the day, leaving little time for personal reflection.

Stephen recounts an operational challenge in London regarding charity accounts that prompted him to propose a more efficient solution. The bank faced challenges when trading with fund managers, often splitting trades among numerous accounts, including charity funds. The process was hindered by the requirement to input specific charity code numbers, causing unnecessary delays. Recognizing the inefficiency, Stephen proposed a change, highlighting the redundancy of blocking whole trades for a single piece of information. After conveying this to his manager and engaging with the UK Treasury, the practice was eventually revised. The outcome benefited not only his bank but all institutions trading with UK asset managers, streamlining operations and reducing complexity.

When asked about disconnecting from work, Stephen acknowledges the importance of setting boundaries, which he personally manages without significant difficulty. In managing his workload, Stephen relies on notes to ensure tasks are completed. A key principle in his role is avoiding assumptions; each problem, no matter how similar to past issues, has to be approached as a unique challenge. Stephen highlights the importance of internal resolution, minimizing direct contact with traders to allow them to focus on their primary responsibilities.

Mistakes are a daily occurrence in any bank, and investigating their origins can be time-consuming. The complexity of trade issues often involves multiple systems and potential IT problems. Stephen describes the intricate process of rectifying errors, from correcting order sequences to addressing discrepancies between client accounts. He emphasizes the importance of adapting to each bank's unique setup, employing an observation period when starting a new role. This allows him to propose streamlined and efficient solutions based on his broad experience. Understanding the intricacies of trade execution, client confirmation, and market data setup is crucial, as is gaining insight into organizational dynamics and compliance regulations within each banking environment.

Stephen anticipates a future in the financial industry marked by continued refinement of regulations, citing examples such as EMIR, MiFID, and MiFID II. As regulations become more stringent, banks will require additional personnel to ensure compliance, diminishing profitability and potentially leading to higher service charges. The shift towards a more regulated environment also necessitates increased automation to manage the evolving market landscape efficiently. This trend reflects the industry's move towards a balance between regulatory adherence and technological advancement. Stephen highlights the downside of increasing rules and regulations in the banking sector.

As Stephen explains in his article, in September 2024, the US equity market will transition to a T+1 settlement, reducing the settlement time for equity trades from three days to one. Stephen emphasizes the challenge this poses, as errors on trades made after March will lead to immediate exchange and settlement the next day. This intensifies the need for meticulous pre-matching and accuracy on the day of trading, adding stress to the middle office.

Stephen envisions a role for artificial intelligence (AI) in the reconciliation process, aiding in ensuring accuracy and minimizing differences in trades quicker than traditional methods.

By the same author:

Hermeto Pascoal: Ella Fitzgerald Stage, July 5th

Hermeto Pascoal : Scène Ella Fitzgerald, le 5 juillet

Plácido Domingo au Victoria Hall : 13 juin

La Nativa : Un café-bar un peu magique

Jean-Michel Jarre, Guest of Honor at GIFF

Image: Sandrina Barroso