Pharmaceutical supply chains are less efficient than fast moving consumer goods and retail supply chains.

Pharmaceutical supply chains are less efficient than fast moving consumer goods and retail supply chains.

This inefficiency is partially explained by the complexity of pharmaceutical product portfolios and regulatory constraints.

How could pharmaceutical entities reduce the complexity in their product portfolios and make their supply chains more efficient?

According to Kevin M. Leiter (see reference below), the reduction of complexity is challenging and difficult to quantify. It requires cross-functional effort and top management buy-in.

Complexity fingerprint identifies the drivers of complexity in a company and helps reduce complexity. For example, pharmaceutical entities sell their products across many markets and often offer multiple dosage forms (tablets, pre-filled syringes, pills, liquid solution, inhaler, eye drops, and patch) and dosage strengths (1mg, 2mg, 5mg, 10mg) in different commercial pack sizes sometimes produced at different manufacturing locations.

Leiter would suggest in this case rationalizing redundant products and complete a tail-end pruning activity.

Tail-end pruning activity targets low volume, low profitability products while the rationalization of redundant products targets products with high sales and high margins that are 100 percent covered by products kept in the portfolio.

Sales, marketing and country management are the leaders in complexity reduction activities, and supply chain management provides active support.

As an example, in the book Playing to Win, by A.G. Lafley, (former chairman and CEO of Procter & Gamble) and Roger L. Martin (former Dean of Rotman School of Management at the University of Toronto) detailed the five choices (the wining aspiration, where to play, how to win, the capabilities, the management systems to support the choices) that define Procter & Gamble's strategy.

Between 2000 and 2016, Procter & Gamble divested more than two hundreds businesses that could not support these five capabilities and reduced the brand portfolio and sold some well-known and profitable brands like Pringles, Duracell despite the fact that many of these brands were USD multi-billions businesses.

Furthermore, these five choices are not specific to Procter & Gamble and other entities could apply them as well.

To rationalize redundant products it is important to get quality product data and the buy-in of top management. The rationalization, however, of redundant products does not solve the challenges related to unprofitable products or low volume products.

Figure 1 Complexity reduction process Source Kevin M. Leiter

Tail-end pruning is a difficult exercise compared to the rationalization of redundant products due to various constraints such as sales volume, production, margins, regions, materials, and alignment with the global strategy and standard operational activities.

Tail-end pruning does not dramatically change the overall cost saving picture.

Both rationalization of redundant products and tail-end pruning are important activities but more important is overall supply chain strategy.

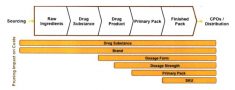

Figure 2 Pharmaceutical value chain and cost implications of pruning different product groups Source Kevin M. Leiter

In the pharmaceutical industry supply chains are usually designed to maximize service levels: high inventory and maximum production output.

According to BCG, supply chains make tradeoffs between service, agility and cost. Pharmaceutical supply chains need to make these same tradeoffs.

Figure 3 Tradeoffs cost, service and agility

Factors that will affect the supply chain tradeoffs are:

BCG propose four supply chain models; cost-effective model, service model, agile model and agile-cost effective model using the three criteria:

Figure 4 Supply chain models

The starting point of supply chain strategy is a clear understanding of market demand and the performance pattern of your respective segments in the following areas:

Sources:

Photo credit: