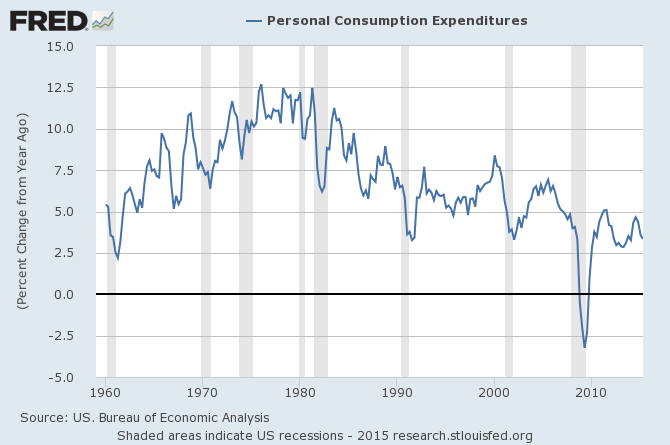

Last Friday's Gross Domestic Product (GDP) report from the US was pretty much in line with expectations at 2.3%. However, looking at the Personal Consumption Expenditures (PCE) on a Year-on-Year (YoY) basis, the picture is much less bright. At 3.3% YoY growth, PCE is still stuck at the bottom range of the last 55 years, excluding the last recession when it was negative.

US consumption represent nearly 70% of US GDP. US GDP leads world GDP, which is why even Switzerland can be affected by personal consumption in the US.

In the meantime, both earnings (-1.3%) and revenues (-3.3%) declined in the second quarter.

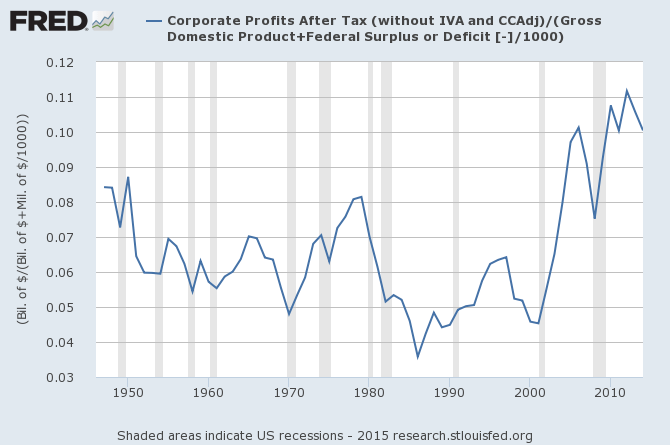

We should also keep in mind that US Corporate earnings are exceptionally high, even on the backdrop of sluggish economic growth, but this series is "mean reverting".

Removing government deficit-surplus from the equation, profits have never been so high since 1950 ( at 10% today vs a 6.5% average).

Said otherwise, government spending has been the first driver of earnings in the post-recession recovery, pushing them well above any previous historical norm. Absent a strong rebound in personal consumption and with government deficit having contracted significantly after October 2013, we may wonder how the markets, almost priced for perfection, can react if the current pattern persists over the 3rd quarter.

There are good and increasing chances that the top in profits is done for this cycle.

Sources:

http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_7.31.15

https://www.stlouisfed.org/

Photo credit: Wikimedia Commons