Switzerland, known for its robust economy and financial stability, has recently undergone a significant change in its taxation structure, particularly concerning VAT.

Here, we delve into the reasons behind the recent increase in VAT rates in Switzerland, exploring the implications for both the economy and individuals.

Definitions

VAT

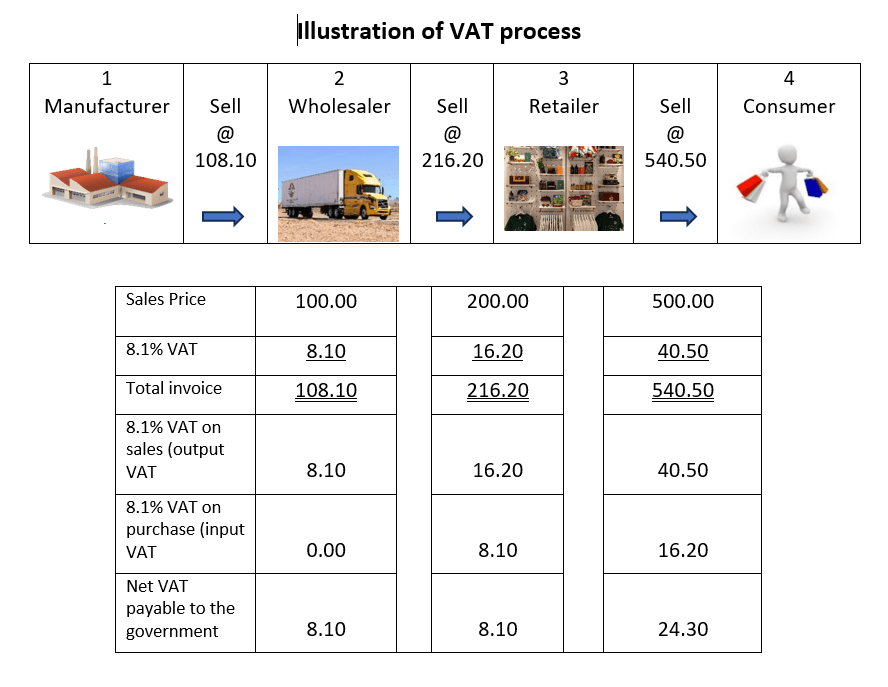

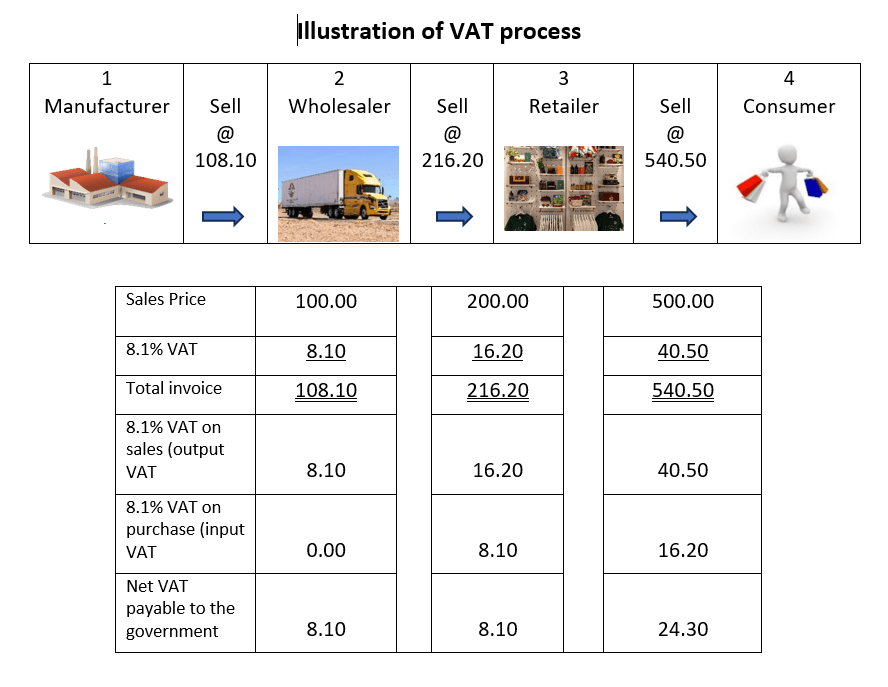

Value Added Tax (VAT) is a general consumption tax imposed by the Confederation.

The concept behind VAT is that consumers contribute financially to the state when they purchase goods or services.

Instead of individual citizens reporting their consumption, VAT is collected from companies (such as producers, manufacturers, traders, and service providers).

Companies then pass on the VAT to consumers, either by including it in the price or separately on invoices.

Input Tax Deduction

Businesses subject to VAT can deduct the VAT invoiced by their suppliers (referred to as input tax).

This deduction occurs when the business acquires services from third-party companies for its taxable activities.

Principle of Net Deduction

The system follows the principle of net deduction, considering prior taxes. All services provided by companies in Switzerland (unless specifically excluded by law) are subject to VAT.

History of VAT in Switzerland

On 1 January 1995, the goods turnover tax was replaced by value-added tax. At that time, the reduced rate was 2% and the special rate was 3%. The standard rate was 6.2%, which was increased to 6.5% by federal decree to restore the health of the federal finances.

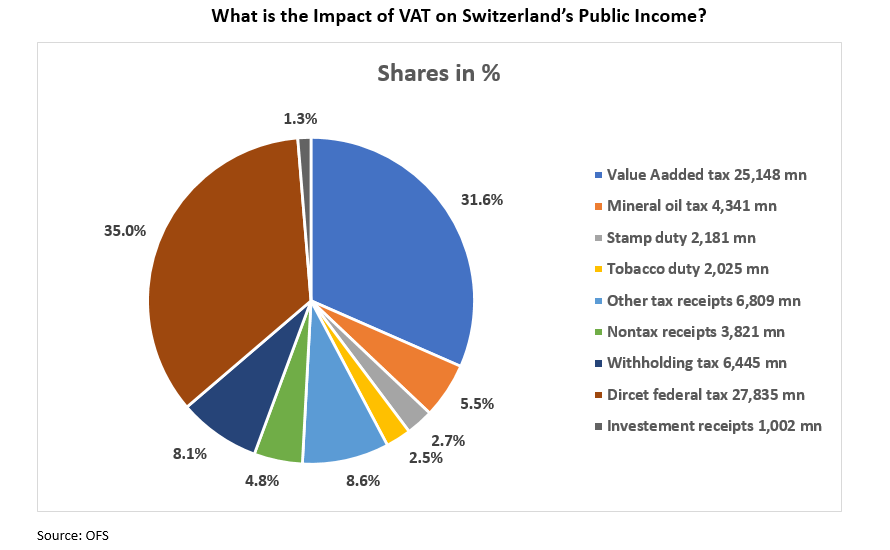

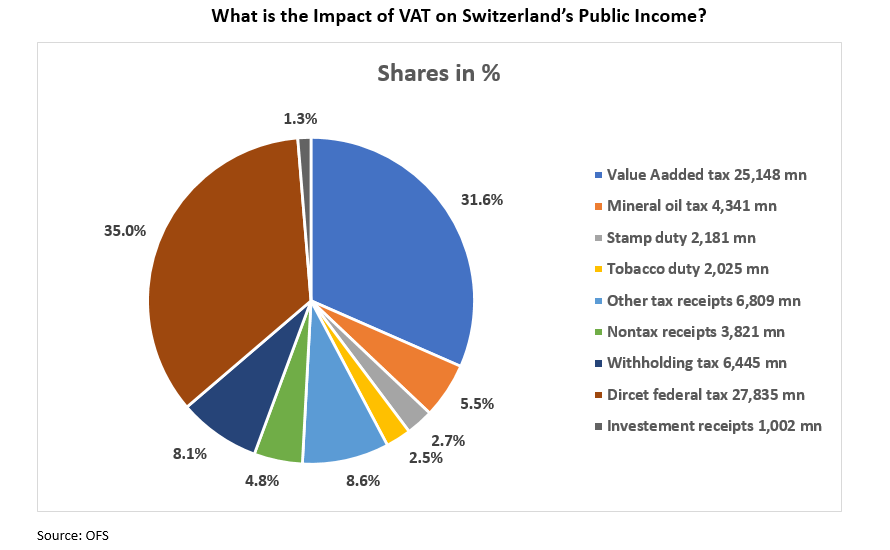

The Value Added Tax (VAT) plays a significant role in Switzerland’s public income. Let’s explore its weight and compare it to other sources of revenue:

- VAT Revenue :

- VAT collections in Switzerland amounted to CHF 25,148 million.

- VAT accounted for approximately 31.6% of total receipts for the Confederation.

- Comparison with Other Sources:

- Alongside direct federal tax, VAT is one of the most crucial revenue streams.

- Domestic consumption drives VAT revenue. This includes taxing the acquisition of domestic goods and services, and imports.

- Notably, exports are exempt from VAT.

From 1 January 2024, the following VAT rates applied in Switzerland:

- Standard rate: 8.1 %

- Reduced rate: 2.6 %

- Special rate: 3.8%

The decision to increase VAT rates resulted from a careful analysis of the current economic environment. This reform aims to ensure the sustainability of the Swiss tax system by adapting to the constantly evolving economic and budgetary dynamics.

For example, the increase will finance the rising costs of public infrastructure, healthcare, and other essential public services. Moreover, Switzerland is currently working on a reform of its Old-Age and Survivors’ Insurance (“OASI” (AVS), the first pillar of the Swiss pension system). In a referendum, in September 2022, 55.1% of Swiss people voted in favor of an increase in VAT rates to finance the OASI (AVS).

The previous VAT rate had been as follows: -

- Standard rate: 7.7%

- Reduce rate: 2.5%

- Special rate: 3.7%

How to determine the VAT rate

Regardless of the VAT rate, the VAT liability is recognized when the service is invoiced or paid for.

In Switzerland, the rate of VAT varies on the types of goods or services, unlike some countries with a single VAT rate.

- Standard rate: applied to most goods and services.

- Reduced rate: applied to certain categories of goods, such as foodstuffs, newspapers, books, and medical services.

- Special rate: applied to accommodation services.

Exempt from VAT: applied for educational services offered by public institutions and certain private institutions; financial services and insurance; postal services provided by SwissPost; and, cultural services, such as those offered by museums, libraries, and theatres.

The impact of VAT increases

The impact of VAT increases

The increased VAT will have an impact on both citizens and companies.

- Impact on prices: companies often pass on the higher tax burden to consumers by increasing prices for their services and products. This will affect consumer behavior.

- Challenges for businesses: small and medium-sized companies must prepare to meet administrative requirements related to the new VAT rates. They face the challenge of covering rising tax costs while maintaining profitability and competitiveness. Adjusting prices strategically and considering short-term offers can help mitigate the impact.

According to RTS, despite the increase, there has not been a widespread rise in prices. Only about 12.6% of products saw price increases between December and January. The Federal Price Supervisor, Stefan Meierhans, attributes this to several factors, including the removal of industrial customs duties and careful monitoring of price developments.

Regarding 2025 and 2026, there are proposals to further adjust VAT rates and pension levies. For 2026, the Swiss Federal Council has proposed two funding plans to cover increased state pension costs:

- Increase VAT from 8.1% to 8.5% and raise the pension levy on salaries by 0.5%.

- Alternatively, increase the pension levy on salaries by 0.8%.

Keep in mind that these proposals are subject to further decisions and may change.

The adjustment in Switzerland’s VAT rates is a strategic move aimed at bolstering public funds for essential services while maintaining economic equilibrium. While it presents certain challenges for businesses and consumers alike, it also reflects a proactive approach towards sustainable fiscal policy amidst global economic shifts. As Switzerland continues to navigate these changes, it remains a key example of adaptive governance in action.

From the same author:

The best accounting software in Switzerland

Sources:

https://www.estv.admin.ch/estv/fr/accueil/taxe-sur-la-valeur-ajoutee.html

https://www.efv.admin.ch/efv/fr/home/finanzberichterstattung/bundeshaushalt_ueb/einnahmen.html

https://www.rts.ch/info/economie/2024/article/la-hausse-de-la-tva-ne-s-est-pas-traduite-en-augmentation-generalisee-des-prix-28451653.html

Images: depositphotos

The impact of VAT increases

The impact of VAT increases